Financial Platform

Table of Content

- Introduction

- Overview

- Vision

- Scope

- Functional Structure

- Tentative Plan

- Liaison with Industry Working Groups

- Integration Points with other Eclipse Projects

- Code Contributions

- Other Open Source projects used in current code

- Organization

- Interested Parties

Introduction

knowis AG and WeigleWilczek GmbH are proud to propose the Eclipse Financial Platform project as an open source project under the Eclipse Technology Project.

This proposal:

- is in the Project Proposal Phase (as defined in the Eclipse Development Process document) and is written to declare its intent and scope.

- is written to solicit additional participation and input from the Eclipse community.

The project Financial Platform will contain other sub-projects like Financial Platform/Common or Financial Platform/Credit Management. Initial Code-Contribution is made from knowis.

You are invited to comment and/or join this project or build another sub-project in Financial Platform. Please send all the feedback to the financial-platform newsgroup.

Overview

The goal of the Financial Platform project is to extend the Eclipse platform to create an open source framework and common infrastructure for interoperable and extensible financial systems.

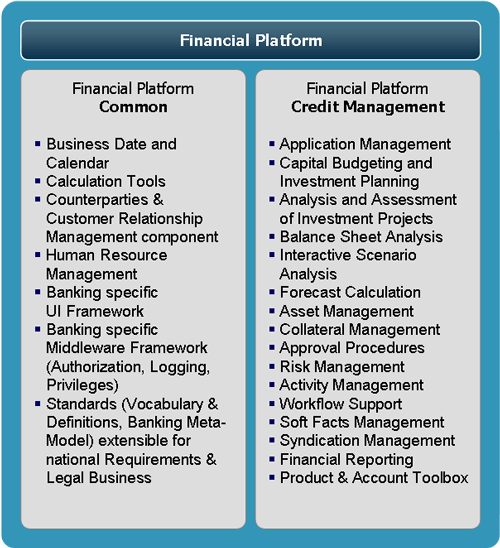

The Financial Platform project proposal includes also more generic sub-projects, such as Financial Platform/Common and Financial Platform/Credit Management.

Sub-Project: Financial Platform/Common

The Financial Platform/Common will develop common tools, concepts and services. All concepts and tools will be made extensible and adaptable for national and international requirements.

Sub-Project: Financial Platform/Credit Management

The goal of Financial Platform/Credit Management is to extend the Financial Platform project to create business-components in the field of credit- and back-office processing as well as to provide continuous business processes support for financial organizations.

The Financial Platform/Credit Management will develop banking-specific tools, concepts and services. All concepts and tools will fit in with the Financial Platform project and will be extensible and adaptable for national and international requirements.

Client development will be based on Eclipse RCP and server components will be based on the EQUINOX OSGI together with the core Eclipse concepts such as plug-in-based extensibility. The results of Financial Platform can be used as base-components for other, external parties and projects.

The essential functional elements of Financial Platform V 1.0 are well understood by domain experts. While there is significant engineering effort required we feel that the work plan as proposed here can be implemented given sufficient resources, and does not involve an unrealistic level of technical risk.

There is no overlap with existing projects. We are aware of no other efforts to build a platform for constructing common financial applications. Consequently, we expect it will take both time and effort to grow a Financial Platform community within the financial industry.

We are optimistic that there will be adequate growth in the team within the first year after passing the creation review and being established as an Eclipse Project. Our development plans are deliberately open ended so that we can employ these additional resources effectively as they become available. If we are wrong in our optimism, our development plan can still succeed, but it clearly will take longer to reach its goals.

Vision

The financial industry has experienced a continuous standardization of its main products since the early 90īs. Financial Platform's goal is to deliver extensible and replaceable open source common business functionality. Several financial open source tools and mathematic libraries can benefit from this platform as an integration point.

Financial Platform project will gain interoperability (between Financial Platform components), ensure an easy integration and will provide the environment for knowledge exchange.

We believe there is the possibility of establishing business components, financial tools and functions, supporting workflows for the financial business. Together with a process for customization to adapt to national standards and requirements Financial Platform allows segmentation from commercial products.

We consider there is a chance to found an extensible vendor-neutral platform that includes common components and basic tools and functions which all support workflows for financial business.

Scope

The scope of the project and all of its sub-projects is business-based; Financial Platform will not develop generic middleware (process server functionality, business rules engine, ESB, etc.). All integration-points are based on available (open-source) products and common standards.

- Financial Platform/Common will develop a basic framework, extensible with other sophisticated financial components such as credit related functions or risk management.

- Financial Platform/Credit Management will develop extensible banking components and credit-management related tools.

knowis will initial contribute code of field-tested components that apply to common and/ or specific financial requirements in an extensible framework. Latest results from academic research and legal requirements can be more easily adopted while using this framework.

Functional Structure

Presentation

All UI components will be developed in an integrated workplace using Eclipse-RCP technology.

Business Logic

The project-core of the Financial Platform can be subdivided into two major parts:

- A highly flexible, specialist banking meta model makes it possible to replicate real world situations easily and completely.

- An abstract controlling layer provides specialist banking operations on top of the Meta model. These can be reused by external applications as banking services.

Persistence and data integration

Access to back-end systems, interfaces and services will be completely encapsulated within the data and integration layer. This allows each banking entity to modify the data link to its back-end systems or databases in accordance with customer requirements. Open standards (e.g. web services, XML) can be employed as well as proprietary communication protocols.

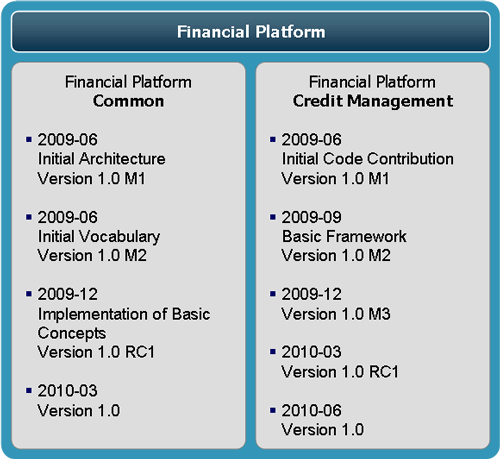

Tentative Plan

We plan to follow a milestone based delivery schedule with incremental progress visible in each milestone. Here is a rough outline of the time line we expect to follow for milestones:

Liaison with Industry Working Groups

- Open Source Business Foundation

Integration Points with other Eclipse Projects

- Equinox is used to implement both client-side and server-side OSGi services as evolved by the OSGi Enterprise Expert Group.

- Riena is used for client-server communication

- RCP is used for client side

- BIRT is expected to be used for Business Reporting

- DTP is expected to be used for database definition

- EclipseLink is expected to be used for ORM

- Higgins is expected to be used for identity, profile, and relationship information across multiple data sources and protocols

- Swordfish is expected to be used for SOA-enabling

Code Contributions

- knowis AG

Other Open Source projects used in current code

- Hibernate

- JBoss jBPM

- Drools

- JasperReports

- Spring Framework

- Joda Time

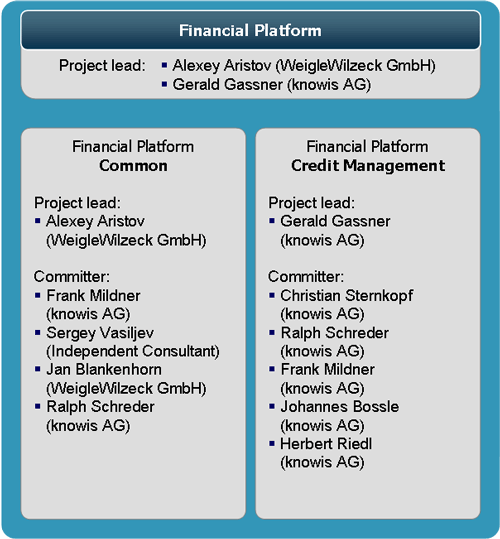

Organization

| Alexey Aristov | Alexey is a senior architect with WeigleWilczek, building enterprise applications for more then 10 years. Alexey is co-project lead and will work on FP Common architecture. |

| Gerald Gassner | Gerald is in software development for financial institutions for more then 10 years. Gerald is co-project lead and will work on FP Credit's technical architecture. |

| Frank Mildner | Frank is senior software engineer with knowis, building enterprise applications for more then 15 years. Frank is responsible for the design and realization for different modules in FP/Common and FP/Credit. |

| Sergey Vasiljev | Sergey is an Independent IT-Consultant. Working for years in the field of Java-EE, he is responsible for the design and realization of different modules in FP. |

| Jan Blankenhorn | Jan Blankenhorn is software developer with WeigleWilczek, building enterprise applications for more then 5 years. He is responsible for creating a testing framework for different modules. |

| Christian Sternkopf | Christian is senior product manager with knowis. He has been working for several financial institutes for 10 years, and is currently responsible for the product strategy of FP/Credit. |

| Ralph Schreder | Ralph is senior software engineer with knowis, building enterprise applications for financial institutions for more then 15 years. Ralph is responsible for different modules in FP/Common and FP/Credit. |

| Johannes Bossle | Johannes is solution architect with knowis, working with Eclipse for more than 5 years. He is responsible for technical architecture in FP/Credit and integration with other FP projects. |

| Herbert Riedl | Herbert is consultant with knowis. He has been working for several financial institutions for about 5 years, and is responsible for different modules in FP/Common and FP/Credit. |

Other participants are more than welcome and being actively sought.

Interested Parties

- knowis AG

- WeigleWilczek GmbH

- Sopera

- Actuate

- OSBF